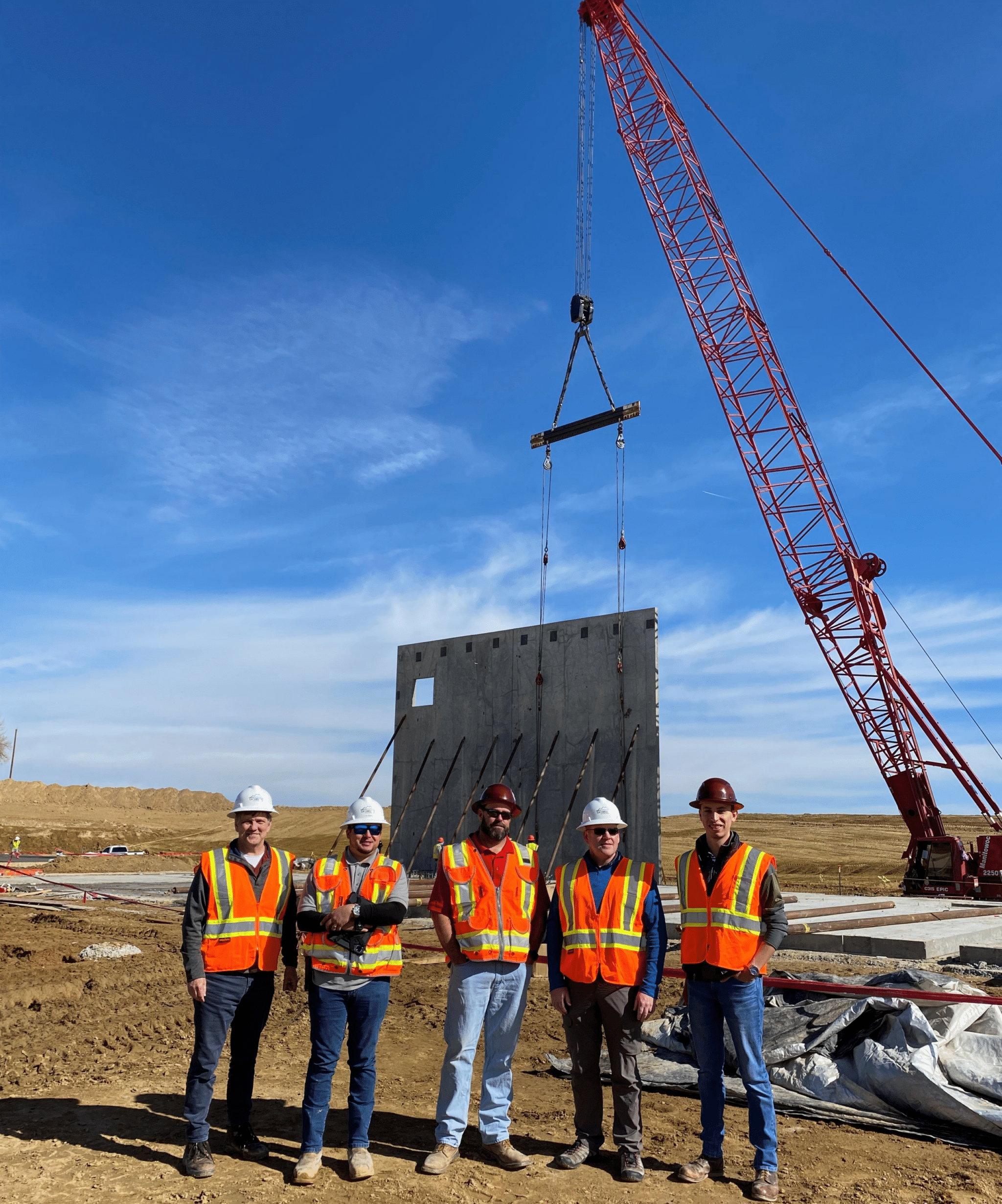

At Catamount, the annual valuation process is a pivotal event that determines the fair market value of shares within our Employee Stock Ownership Plan (ESOP). Led by an independent third party, this process occurs each spring and calculates our stock value and share price. Simply put: the valuation calculates the share price, which determines how much the ownership stake is worth. This valuation is important in that it directly impacts the future wealth generation of each employee-owner.

THE BASICS

- Third-Party Valuation:

An independent third party conducts a thorough annual review of Catamount to determine the company’s value. - Comprehensive Analysis:

This analysis includes an examination of year-to-date financial performance, the current project pipeline, and internal and external value drivers. - Executive Engagement:

Interviews are completed with key stakeholders. Therefore, they include the CEOs and CFO among other executives, to provide crucial insights into Catamount’s operational landscape. - Valuation Calculation:

The valuation company further consolidates financial data and additional research to arrive at a final valuation. Once the valuation is complete, it’s subject to approval by the Trustee.

The valuation calculation is based on two primary components:

- Enterprise Value: Reflecting the ongoing operational worth of Catamount

- Equity Value: Catamount’s enterprise value + cash – debt + nonoperation assets/liabilities

Details of the valuation process can be complex, but at the same time, it helps all employee-owners understand how their daily actions impact the ESOP. Employee ownership is a distinctive aspect of Catamount’s identity and a testament to our shared commitment. It is the heart of our culture where everyone is heard and has the opportunity to thrive. This ownership mentality is what sets Catamount apart and allows us to focus on providing best-in-class service to our project partners every single day!

To #ActLikeAnOwner, our employee-owners need to make informed decisions to collectively support personal and company growth. Acting like an owner means approaching every day looking for chances to go above and beyond. Supporting fellow employee-owners, seeking out opportunities for growth, and taking ownership of outcomes.